(A Plain-English Guide from Capstone Roofing)

Let’s begin by stating the obvious: you and your family experienced a loss — and potentially a tragic event — that damaged your home, one of your most valuable assets. We understand and have been there too. We are here to help. Use this guide to educate yourself about the process and hopefully ease your mind. We help families through this potentially stressful process every day.

It’s important to understand everyone’s role in restoring your house.

You (Policyholder): You are the boss. You own the home, bought the insurance policy, and need to be made whole.

Insurance Adjuster: Represents the insurer’s interests — investigates to determine coverage while complying with your policy. They’re trained but may miss details; always be polite but firm if you disagree.

Roofing Contractor (Capstone): We work for YOU. You hire us as the experts for assessment and repairs. We provide credibility during the inspection and ensure your home is restored to pre-storm condition.

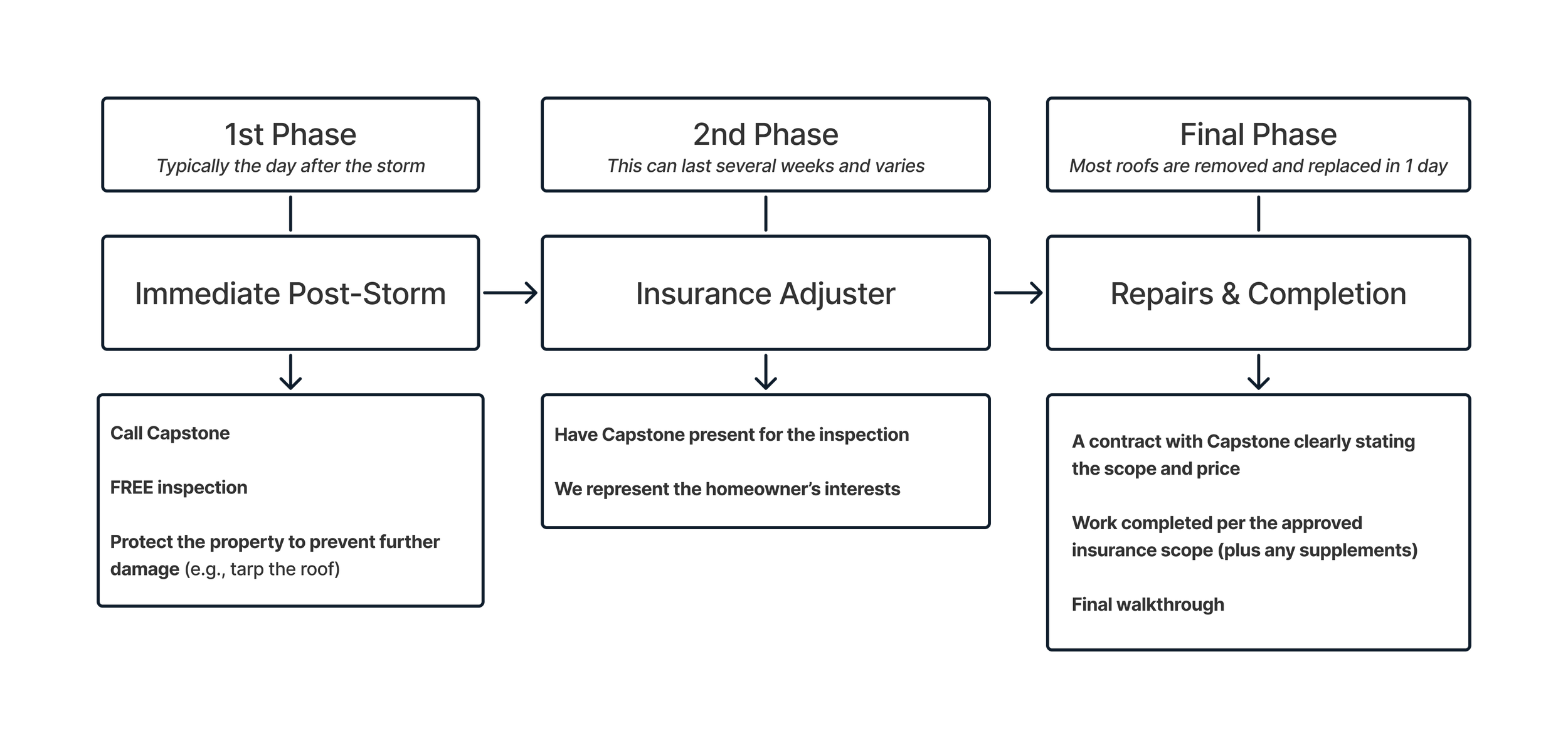

The Insurance & Claim Process

-

Safely inspect the roof (do not climb if unsafe — call Capstone). Document with photos/videos from multiple angles, timestamps, and notes on storm date/time.

Call Capstone and let us know what you found or suspect. We will meet you on site for a FREE inspection and protect the property to prevent further damage (e.g., tarp the roof). We’ll begin documentation and discuss concerns with you. If we both agree damage is present, you (or we can help) call your insurance company to file the claim.

-

You coordinate the adjuster inspection. When you file the claim, we’ll offer 2–3 time slots to make scheduling easy. Remember: you are the boss — Capstone and your insurance company are here to serve you.

Have Capstone present for the inspection. We represent your interests; the adjuster represents the insurance company. Healthy, competing interests keep everyone honest.

-

The adjuster finalizes the report and the insurer approves/denies the claim.

Approved? We begin repairs.

Something missed? Capstone submits a supplement (extra scope) with photos and evidence to ensure your home is restored in full.

Denied? We walk you through escalation steps (appeal, public adjuster, TDI complaint).

-

When you accept the offer, the insurer sends Check #1 (usually Actual Cash Value minus your deductible).

You pay your deductible directly to Capstone — this is required by Texas law.

The insurer holds back depreciation until repairs are complete. After we finish and proof is sent, they release Check #2 (the recoverable depreciation).

-

You sign a contract with Capstone clearly stating the scope and price. We complete repairs per the approved insurance scope (plus any supplements).

When work is done, we submit:

Final invoice

Photos of new roof

Proof you paid deductible

Insurer releases final depreciation check.

-

We do a final walkthrough with you, address punch-list items, and collect final payment. We explain warranties and stay in touch.

Simplified Process

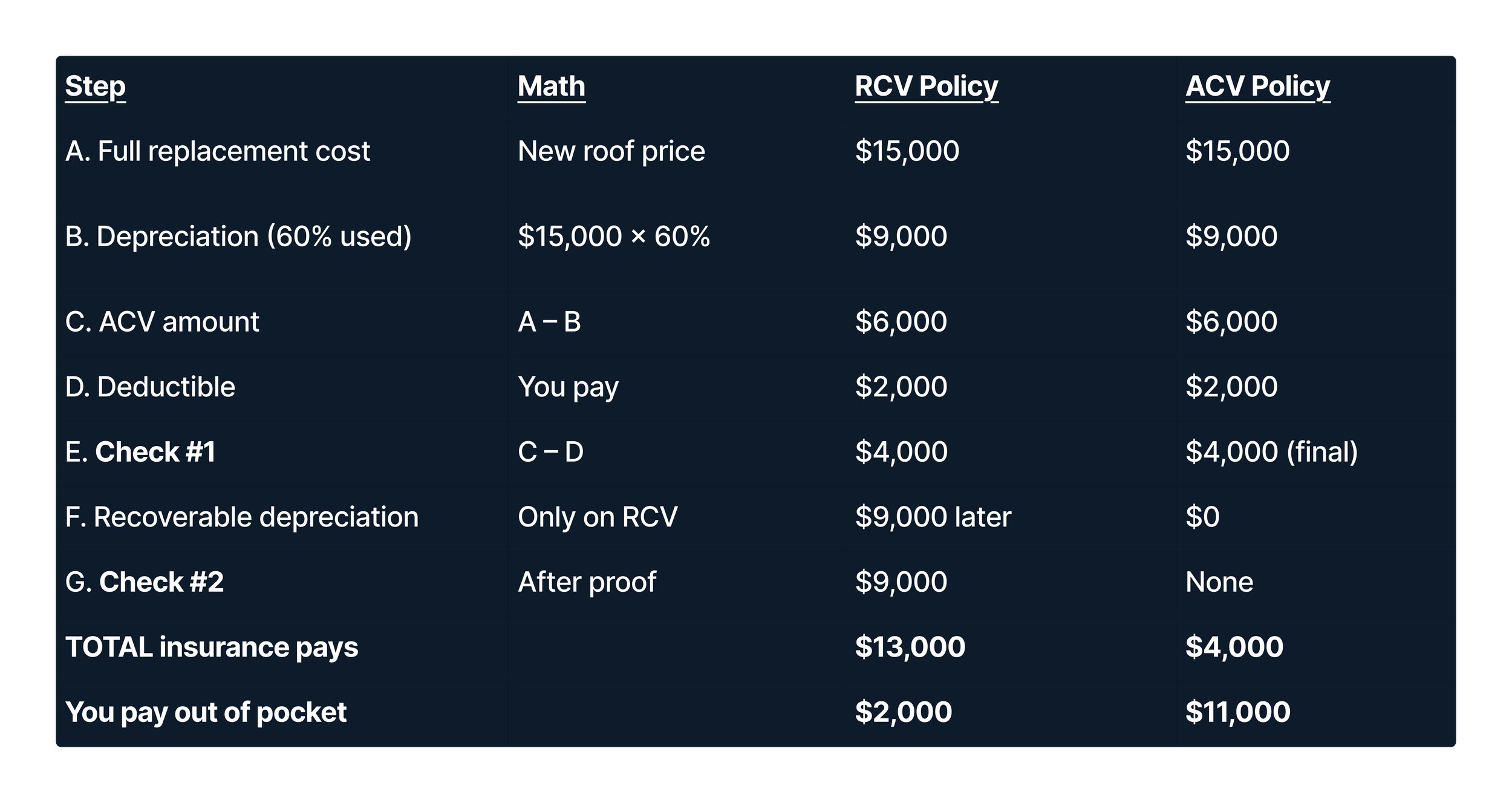

Important Terms: ACV vs. RCV

(Texas Homeowner with a $15,000 roof repair bill)

Texas Legal Notes

Deductible waivers are illegal (Texas HB 2102).

Capstone never absorbs your deductible — it’s fraud.

Check your policy: Most Texas roofs under 15 years are on RCV.

Call Capstone first.

We inspect FREE, guide you through the claim, and restore your property.